Life insurance is a financial contract between an individual and an insurance company that provides payment to the beneficiary in the event of the policyholder’s death. This policy helps ensure that the loved ones of the policyholder can maintain their standard of living without financial worries.

Having life insurance is important as it provides security to the policyholder’s loved ones in the event of unforeseen circumstances. The policy provides a payout to the beneficiaries. Which can help pay off outstanding debts, mortgages, and other expenses that the policyholder may have left behind.

When it comes to offering life insurance rates, insurance companies follow specific rules. These rules help to ensure that they are offering policies that are fair and reasonable to both parties involved. Insurance companies evaluate the risk of providing policies based on factors such as age, health, income, and occupation, among other things.

As a pilot, one may wonder whether it’s possible to get life insurance. Pilots indeed face specific risks and challenges that make insurance underwriters pause before insuring them. So today, we’re dedicating this post to talking about whether or not pilots can get life insurance.

Can Pilots Get Life Insurance?

Yes, pilots can get life insurance. However, since flying is considered a high-risk profession, not all insurance companies offer life insurance for pilots. Nonetheless, there are still some companies that do offer life insurance policies for pilots. This means that as a pilot when shopping for life insurance, ensure you ask if the insurer offers policies to pilots.

Pilots do have slightly unique situations when it comes to life insurance policies. The risks associated with flying can be a concern for insurance companies. Such as the risk of death in case of an air crash. Hence, premiums for life insurance policies for pilots might be higher than the ones offered to people in other professions nonetheless.

Insurance companies that offer life insurance for pilots have strict and fairly detailed guidelines. The guidelines are meant to ensure that the pilot’s health and history are taken into account to determine the level of risk to the insurance company.

Factors such as age, health status, lifestyle habits, and family health history are considered as applicants go through underwriting to assign a risk class. Logged flying hours and flying experience all play a significant role in determining the premiums and underwriting that will be offered. This means that two pilots with similar work operations can be offered different premiums based on personal peculiarities.

Best Life Insurance For Pilots

Pilots are good candidates for life insurance because they tend to be generally healthier than most, earn income, and are well educated. There are two different categories of life insurance available for pilots. These are term life insurance and permanent life insurance.

Term life insurance covers the insured for a specific duration of time which can last from 10 to 40 years. Permanent life insurance as the name suggests will cover the insured for their entire life. Both policies have their unique advantages depending on the preference of the insured. As well as the benefits that come with it for the immediate family.

Term life insurance helps to provide protection during the prime earning years of the insured. It is a far more affordable life insurance option in comparison with permanent life insurance. Though it is more expensive, permanent life insurance helps to gain peace of mind. Such as when a pilot has a child with special needs who might be dependent on for the rest of their life.

Here’s a closer look into some of the best life insurance policies for pilots, what to expect, and what to consider with such policies.

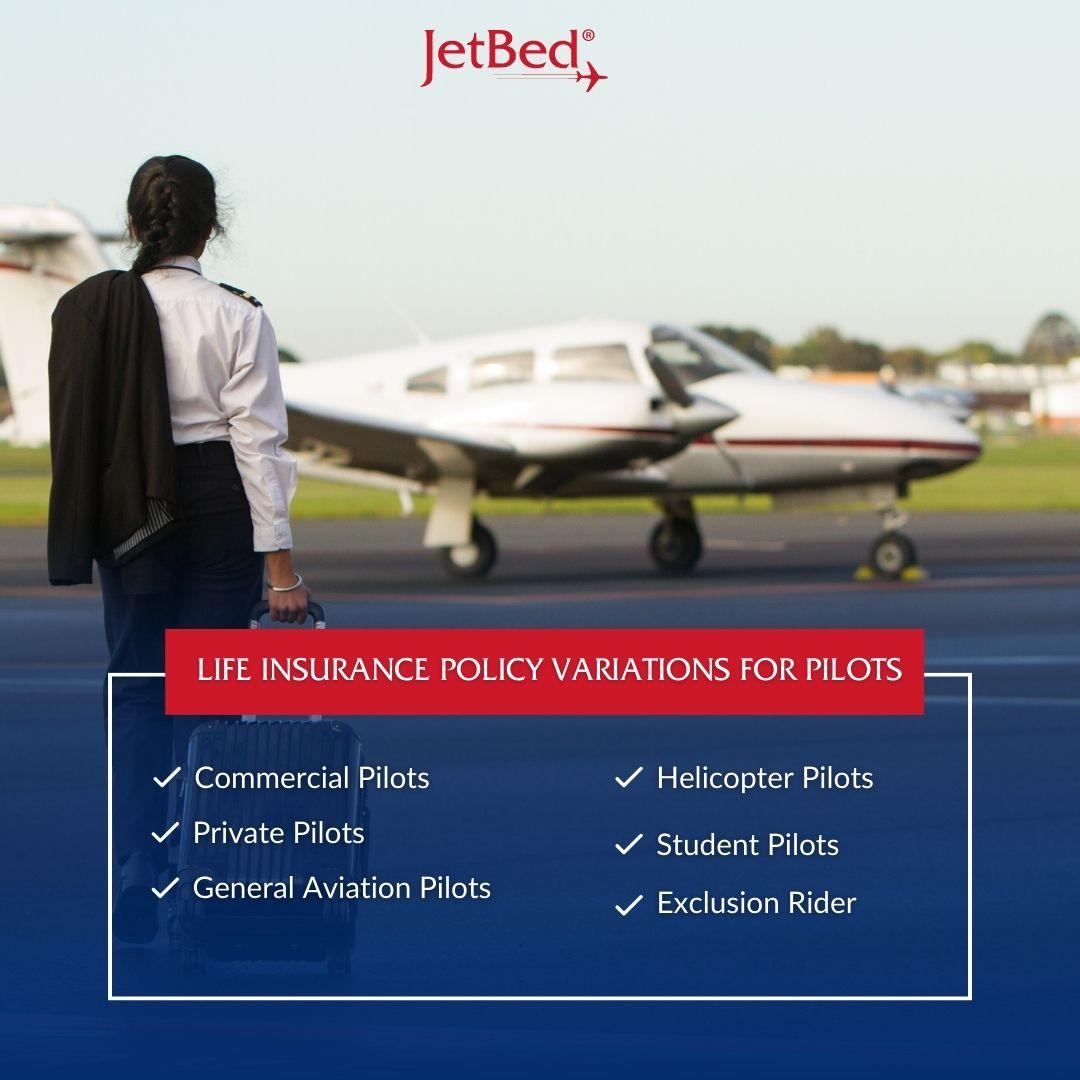

Life Insurance for Commercial Pilots

The most favorable underwriting among pilots is usually offered to pilots of civil air carriers of major airlines in the U.S. The reason for this is not so far-fetched because such pilots have to concede to strict rules that govern the airlines as stipulated by the FAA. Commercial pilots have a fatal accident rate that is 35 times better when compared to all other types of pleasure flying combined.

Underwriters will also want to know if you engage in other flying activities before reviewing your application. Such activities include helicopter flights, glider flights, light aircraft, private flights, or flight instructors. While these activities are common with commercial pilots, they are not an issue but they are factored in while calculating premiums to offer.

Life Insurance for Private Pilots

Private pilots face slightly higher risks than commercial pilots. And this affects the premiums available to them for life insurance. For a private pilot, life insurance companies consider the type of aircraft flown and the purpose of flights. As well as flying hours per year, type of license held, and flying experience. All of these are used in assessing the type of premiums to offer to each pilot.

Pilots who fly over 150 hours per year have been proven by research to be more prone to accidents due to increased exposure. Likewise, pilots with less than 30 hours per year present a high risk for accidents due to their relative inexperience. Such increased risk of individual applicants requires pilots to pay a flat extra after being approved for life insurance.

In simple terms, a flat extra is an additional premium added to the basic premium that covers life insurance. This additional premium depends on the increased risk associated with the applicant and is usually a fixed amount per thousand dollars of coverage. Flat extras can last for just a few years or the entire policy term depending on the situation.

Life Insurance for General Aviation Pilots

General aviation pilots are considered pilots involved with all civil aviation operations other than scheduled air services and non-scheduled air transport operations for remuneration or hire. Such pilots fly all types of crafts including gliders and helicopters, which will also be factored in their underwriting for calculating the premiums they will be offered.

Flying experience, logged flying hours, and flight schedules in terms of how many pilots fly a plane are always important for calculating the premiums of general aviation pilots. It is possible for some to not have a flat extra on their basic premiums based on the assessment of the insurance carriers.

Life Insurance for Helicopter Pilots

Helicopter pilots pay a flat extra depending on the purpose of flying. Be it for pleasure, personal business, or as a commercial helicopter pilot. Pilots who fly for pleasure or personal business are less likely to pay flat extra. Whereas those flying for hire are more likely to pay. Additional factors to determine the flat extra are lifetime flight hours and flight ratings such as IFR. In addition to the total number of hours flown yearly.

Helicopter pilots with sufficient solo hours and flight hours per year are more likely to qualify for a preferred rate. Risks that come with flying for hire differ as a helicopter pilot that performs aerial suppression of wildfires isn’t at the same type of risk as a helicopter pilot for an offshore oil company or the police department. A good medical history also helps to increase the chances of affordable life insurance.

Life Insurance for Student Pilots

Student pilots also have provision life insurance coverage. As trainees, they undergo rigorous training exercises and qualification processes for several years. This series of qualification processes involve flying light aircraft and comes with a certain degree of risk. This makes having life insurance cover a reasonable plan.

Student pilots are classified as a slightly higher risk compared to when they become fully qualified. This means the premiums offered will be slightly more than those offered when fully qualified.

Aviation Exclusion Rider

An aviation exclusion rider is a clause included in life insurance policies for pilots. It requires no coverage to be paid if the cause of death is related to flying. In the instance that the cause of death is unrelated to flying, the insurance company will be required to make full payment to beneficiaries.

Aviation exclusion riders were more commonly offered when top-rated life insurance companies made offers to pilots in the past. This was mostly due to the perceived risks attached to the profession. But this has since reduced with advancements in aviation safety management systems and technology. Aviation exclusion riders are now applied if a pilot has additional risk factors such as a history of epilepsy or an aviation violation.

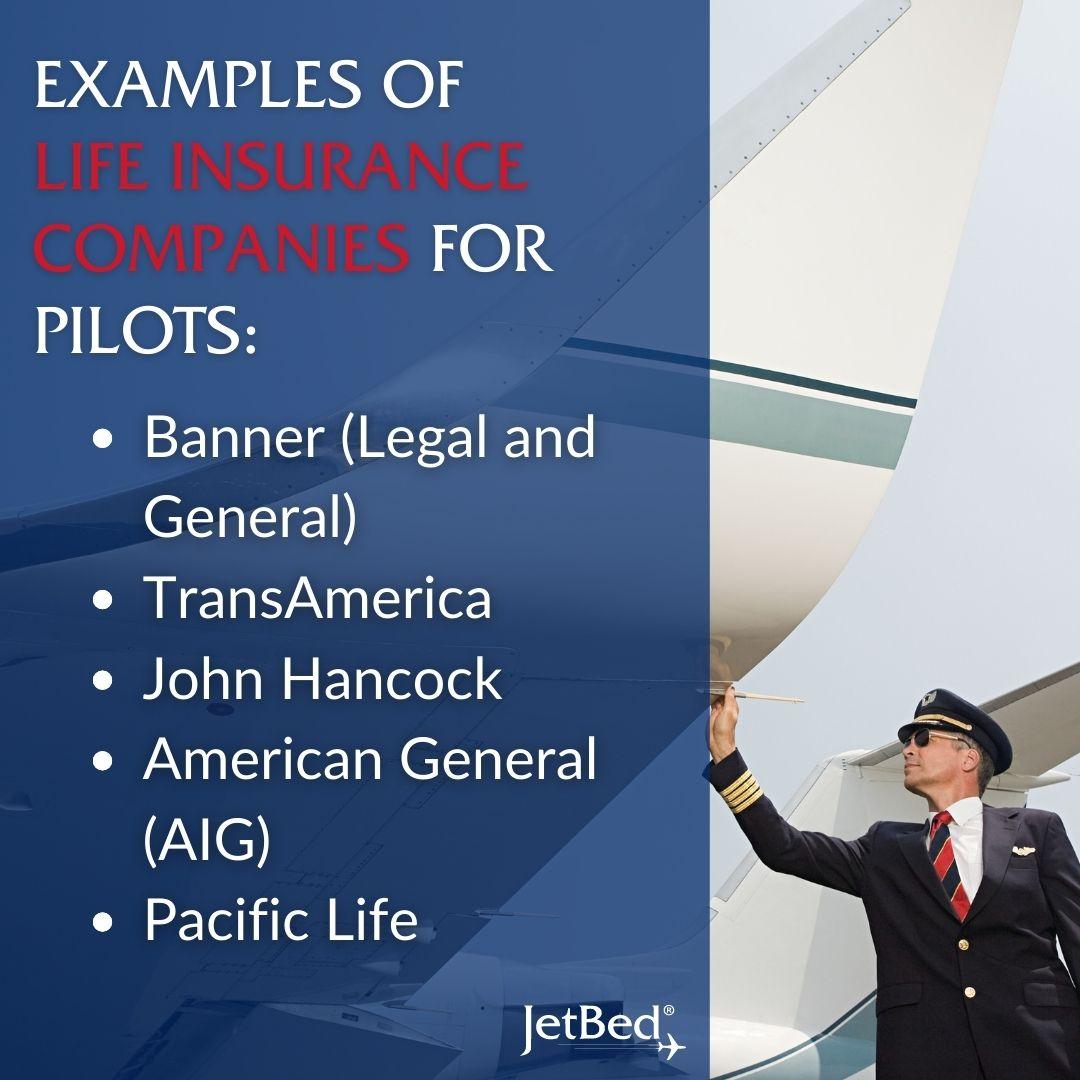

Examples of Life Insurance Companies for Pilots

Pilots can and should get life insurance.

As a pilot, getting life insurance is a crucial aspect of financial planning that must be considered. While there are different options available, it is important to compare different policy options before choosing the ones that best suit your needs. Ultimately, life insurance helps to give you and your loved ones peace of mind. Knowing that they will be taken care of when you are no longer around.

When your pilot life insurance is settled, enjoy the best of comfort while flying with JetBed. With different state-of-the-art options to suit various aircraft, JetBed ticks all the boxes for all you need to make your aircraft seats comfortable and durable. More on how you can easily design and purchase the right JetBed for you on our website, HERE.