Private jets, the epitome of luxury and exclusivity, offer a level of comfort, convenience, and privacy that few can resist. These fast machines have long been the symbol of opulence, attracting the likes of celebrities, business moguls, and high-net-worth individuals. Beyond the allure of soaring the skies in unmatched style while resting on your Jetbed, the tantalizing prospect of tax benefits has made the idea of purchasing a private jet more appealing.

In today’s post, we’ll delve into the tax deductibility of private jets and explore the various tax breaks available to private aircraft owners. Join us on this journey as we unravel the complexities of tax law and reveal the opportunities and pitfalls that come with the soaring aspirations of private jet enthusiasts.

Are Private Jets Tax Deductible?

Yes, private jets can indeed be tax deductible, but it’s crucial to understand the laws governing this privilege. The Tax Cuts and Jobs Act, which took effect in 2018, brought significant changes to the taxation of private jets and their associated expenses.

Under these tax laws, private jet owners can benefit from deductions such as bonus depreciation, provided they meet specific criteria. This means that a substantial portion of the jet’s cost can be written off in the year of purchase be it by fractional ownership or chartering.

However, it’s essential to use your private jet primarily for business purposes to qualify for these deductions. Keeping meticulous records of flights and expenses related to business activities is also crucial.

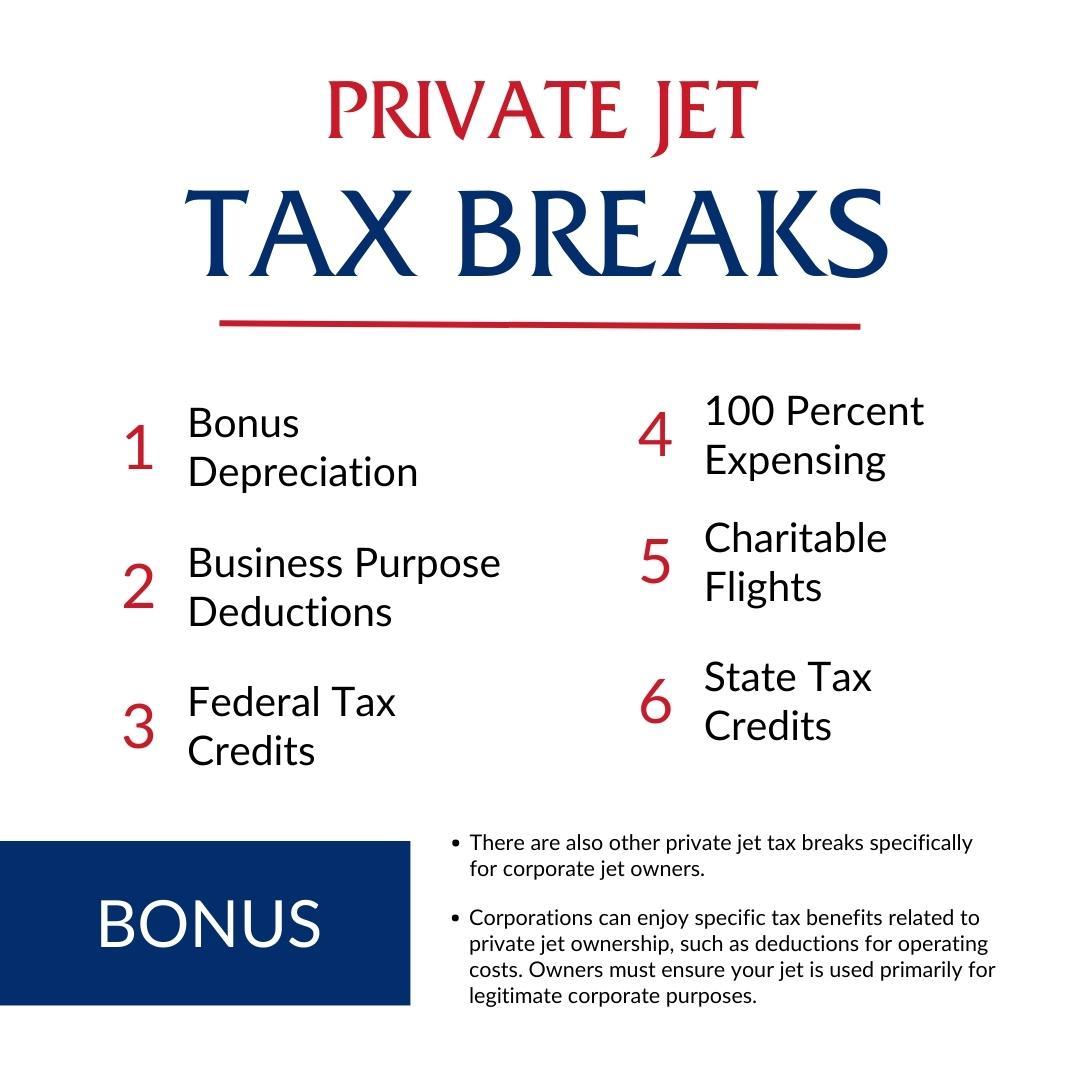

Private Jet Tax Breaks

1. Bonus Depreciation

Bonus depreciation is a substantial tax break available to private jet owners. Under the Tax Cuts and Jobs Act, you can deduct a significant portion of your jet’s cost in the year it was purchased. This allows for faster depreciation and more substantial initial tax savings.

To be able to take advantage, ensure your private jet is used primarily for business purposes to qualify for bonus depreciation. Consult with a tax professional to calculate the eligible depreciation amount and adhere to Internal Revenue Service (IRS) guidelines.

2. Business Purpose Deductions

Private jet expenses incurred for legitimate business purposes are often tax-deductible. This includes costs related to fuel and maintenance, and even the lease or loan interest payments.

To take advantage, maintain meticulous records of all expenses related to business activities. Document the purpose of each flight to demonstrate that it was for a genuine business need.

3. Federal Tax Credits

Federal tax credits can be available to private jet owners engaged in specific activities. For instance, if your jet is used for research and development, you may qualify for tax credits, reducing your overall tax liability.

Identify eligible activities and expenses that qualify for federal tax credits. Also, consult with a tax advisor to ensure proper documentation and filing procedures.

4. 100 Percent Expensing

Under the Tax Cuts and Jobs Act, private jet owners can expense 100 percent of the aircraft’s cost in the year of purchase. This means you can potentially deduct the entire purchase price in one tax year.

Work closely with a tax expert to navigate the complexities of 100 percent expensing. Also ensure that your jet purchase qualifies for this deduction under IRS guidelines.

5. Charitable Flights

If you use your private jet for charitable purposes, such as flying for humanitarian missions or medical transport, you may be eligible for deductions related to these activities. Charitable deductions can help offset some of the costs associated with jet ownership.

Ensure that the charitable flights adhere to IRS guidelines and qualify for deductions. Likewise, maintain detailed records of these flights and related expenses.

6. State Tax Credits

In some states, private jet owners may qualify for tax credits related to job creation and economic development. These credits aim to incentivize private jet ownership as a means of boosting local economies.

Investigate the availability of state tax credits for private jet owners in your region. Consult with tax experts who specialize in state tax law to maximize these credits.

BONUS:

- There are also other private jet tax breaks specifically for corporate jet owners.

- Corporations can enjoy specific tax benefits related to private jet ownership, such as deductions for operating costs. Owners must ensure their jet is used primarily for legitimate corporate purposes.

Though private jet ownership offers tax benefits, navigating the complex tax laws remains vital.

Private jet ownership can offer substantial tax benefits, including bonus depreciation, business purpose deductions, and more. However, it’s crucial for jet owners to adhere to the tax laws, maintain detailed records, and seek professional guidance to maximize their tax advantages. Always stay updated on the evolving tax regulations, as they can impact your tax bills and overall financial planning.

Of course, always ensure your jets are equipped with JetBed. The innovative product turns your jet seats into luxurious, comfortable beds for optimal in-air sleeping. It’s easy to use and lightweight, and with our large collection of options to fit almost every aircraft, there’s no reason it’s not available on every private aircraft you board! After all, every other experience will improve aboard a private jet. So, don’t settle for less when it comes to chartered flights; keep JetBed on your must-have list!